Crypto curiosity leads Political Science student to lab position researching digital currencies

Like many people in the mid 2010s, Anwar Sheluchin was hooked by Bitcoin. But unlike most, she decided to turn that passion into an academic pursuit at McMaster, where she’s now undertaking a PhD and working in a lab project researching digital currencies.

“Once I finished my undergrad, I actually was working full time in the financial district in Toronto,” she said. “And this also happened to be around the time when Bitcoin was constantly in the news, and so I was really intrigued by it and fell into a rabbit hole learning more about the technology and the digital currency itself.

“And I thought, ‘I’m spending a lot of time reading about this, maybe I should research it!”

That decision led Sheluchin to completing her master’s, before continuing onto her PhD in the department of Political Science while working in the Digital Society Lab, where she’s currently leading a digital currencies project.

That project team, which includes Clifton van der Linden, Ori Freiman, Jordan Mansell and John McAndrews, is looking into public attitudes towards central bank digital currencies (CBDCs).

What are CBDCs?

There’s no one-size-fits-all definition of CBDCs, as they can take multiple forms, with varying degrees of centralization.

Essentially, it would differ from current digital currency (for instance, the money in your bank account) in the control that the central bank (in Canada’s case, the Bank of Canada) would have over the money you use.

In its most centralized form, a CBDC would mean that the central bank controls all digital currency in a country, potentially becoming the dominant form of money, with no cash in circulation. However, no central bank is advocating for a cash-free system, they consistently emphasize that a CBDC would complement, not replace cash. Right now, if you go out to dinner with a friend and they pick up the bill, if you transfer them the money later, you log into your app, say on CIBC, and send the money to their TD account. That money is backed up by their reserves, and the bank settles its debts with the central bank and other banks at regular intervals.

A CBDC would essentially take the middleman (the bank) out. You could store your money directly in the central bank– imagine the institution code 000– and if you pay a friend for picking up your half of the bill, the central bank would just switch the money between the two accounts.

But that’s only one of many formats that a CDBC could take. A ‘softer’ version would be one where the central bank has a central currency, but you still bank with a private institution like normal to access the CBDC.

Like the Bitcoin that led Anwar on this journey, a CDBC could utilise blockchain technology.

There are a host of benefits to CBDCs, such as efficiency, more monetary policy levers and preventing crime. And there are a host of downsides, such as privacy concerns and the erosion of the private banking sector.

Digital Society Lab

Many central banks, including the Bank of Canada, are researching the possibility of CBDCs and have launched surveys to canvass public opinion.

And that’s where the DSL lab where Sheluchin works comes in.

“There are a lot of questions that are going unanswered about CBDCs,” she said. “And I think that’s part of the reason why there are so many people who are concerned about a full-on adoption of CBDC. Like, what happens if there’s no internet? Can you still access your money?”

The lab team is trying to understand how a CBDC would impact democratic society, but also to include a diverse range of voices in the consultation phase.

One of the concerns of the lab team is that those who engage with the Bank of Canada’s surveys are already invested and are biased against the idea of the currency. But a large proportion of the general population don’t fully understand the concept, simply because it’s new and there’s a lot of uncertainty as to which form it would take.

So the team decided to run their own survey, to compare against the Bank of Canada’s. In March 2024, they surveyed over 2,600 Canadians representing a cross-section of society. The results were at odds with the Bank’s. For instance, 87 per cent of the Bank’s sample reported being familiar with the concept of a digital Canadian dollar, whereas only 23 per cent of the team’s sample said the same. The team also found that their sample was more trusting of the Bank’s ability to implement the system, and were more open to using it.

In the end, it showed the team that more work needs to be done in involving the public in developing a system that could radically change our monetary system.

But that’s not the only project that Sheluchin has worked on. During the height of the pandemic, she worked in a lab team that examined public responses to government interventions against the infection.

The experiments that the team worked on resulted in two papers: one on mask usage, and one on the gendered impact of the pandemic.

“And no surprise there,” said Sheluchin, “it was women who were impacted the most, especially as it related to childcare.”

PhD Research

But Anwar’s work doesn’t end there. Along with her work in the lab, she’s working towards her PhD on monetary policy in the digital age, specifically how cryptocurrency and central bank digital currencies tie into it.

It’s a PhD in three parts: the geopolitics of CBDCs, public attitudes towards CBDCs, and why politicians sometimes endorse unpopular policies such as cryptocurrencies.

“The work that I’m doing in my dissertation is separate from the lab, but it also complements the lab because I have that expertise and because I’m able to engage with other lab members in terms of shaping the next stages of the lab’s CBDC project,” she said.

And Sheluchin says that collaboration is all too common at McMaster, where your fellow students and faculty members want you to thrive.

“One of the great things about the Political Science department is that it is very collegial and collaborative,” she said. “It has been a great experience for me in terms of being able to just drop into someone’s office and talk to them about my research and they’re totally happy to do it.

“And that’s what I really like about our department: it’s very open and friendly and people just love to talk about research.”

Research, Student StoriesRelated News

News Listing

CBC News ➚

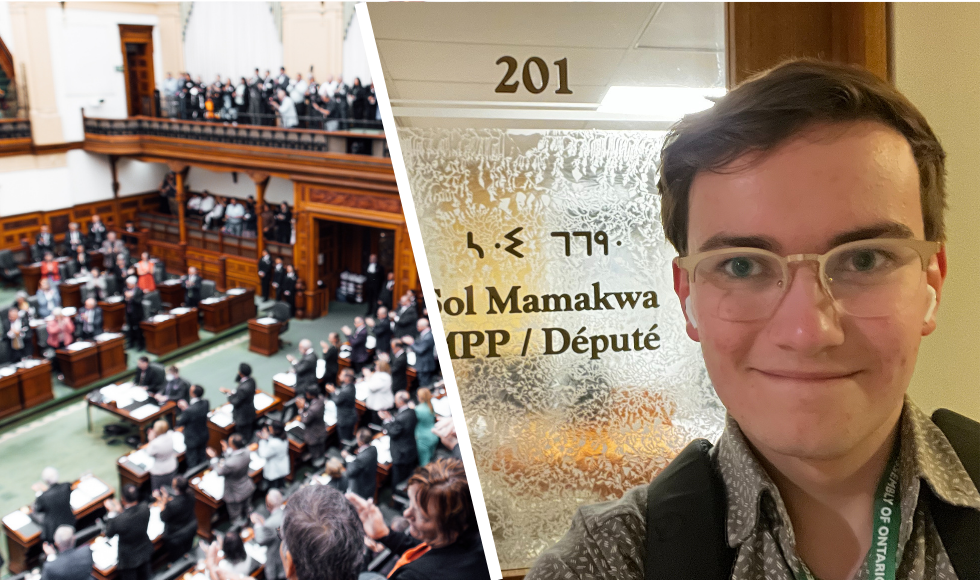

How a 21-year-old McMaster student landed an interview with Iceland’s former PM, Katrín Jakobsdóttir

Student Stories

October 17, 2024

Co-op student Caleb Smolenaars reflects on ‘incredibly rewarding’ work placement with NDP MPPs

Careers & Experiential Education, Student Stories

October 9, 2024